Sorry, Readability was unable to parse this page for content.

Marissa Mayer Jon Lord Colorado shootings dark knight rises Aurora shooting James Eagan Holmes jeremy lin

Sorry, Readability was unable to parse this page for content.

Marissa Mayer Jon Lord Colorado shootings dark knight rises Aurora shooting James Eagan Holmes jeremy lin

* Media reports on killing challenge defence claims

* Steroid influence could be defence

JOHANNESBURG, Feb 18 (Reuters) - Ever since 'Blade Runner' Oscar Pistorius's girlfriend was shot dead in his Pretoria home last week, South African papers have printed lurid details of the killing which, if true, pose major challenges to the Paralympic star's defence team, experts say.

Initial reports of the shooting in the early hours of Thursday suggested Pistorius, 26, a double amputee who became one of the biggest names in world athletics, may have mistaken law graduate and model Reeva Steenkamp for an intruder.

A statement released by his family dismissed the charge of murder laid on Friday in "the strongest terms". His bail hearing resumes in a Pretoria magistrate's court on Tuesday.

Within hours of the shooting, police confirmed that Steenkamp had been killed by more than one gunshot, that Pistorius was the only suspect, that neighbours had heard earlier disturbances, that there were no signs of a break-in and that a 9mm pistol had been recovered from the two-storey home.

Since then, police have released no more details.

The same cannot be said of the South African media, part of a global publicity machine that built up Pistorius into the ultimate sporting tale of triumph over adversity - a man who rose to the pinnacle of world athletics, racing at the Olympics despite having no lower legs.

Some of the most widely reported local media allegations are that Steenkamp was in the bathroom when she was shot, was hit by four rounds - in the head, hand, hip and chest - and that shots were fired through the bathroom door.

In addition, leading Sunday newspaper City Press said investigators had found a blood-stained cricket bat in Pistorius' bedroom. The paper said police had not yet worked out whose blood it was, but said Steenkamp's head was "crushed".

The newspaper also alleged that Steenkamp, who will be buried on Tuesday, had slept in the same bed as Pistorius that night - Valentine's Day eve - and that her iPad was on the bedroom floor along with an overnight bag.

The ENCA television channel said CCTV footage from the gated community showed Steenkamp arriving at the complex shortly after 6 p.m. on the previous evening.

Police have declined to comment on any of the reports, saying official details will only emerge in court.

However, the allegations - if true - undermine the legal argument of self-defence, as well as the suggestion that Pistorius was taken by surprise by a would-be stranger in his house in the middle of the night.

"If what the media says is in fact the truth, I cannot see that any defence based on self-defence can, by any stretch of the imagination, succeed," said Eddie Classen, a partner at BDK Attorneys, one of South Africa's biggest criminal defence firms.

"ROID RAGE"?

Under the white-minority rule that ended in 1994, South Africa had relatively lax curbs on the use of lethal force, not only in self-defence but also in making arrests. Put bluntly, if the only way to stop a fleeing robber was to shoot him, you could.

However, the laws were tightened up after the end of apartheid when the "right to life" became enshrined in the new constitution of Nelson Mandela's "Rainbow Nation", making it permissible to use lethal force only when your life is directly threatened.

Furthermore, when the immediate threat is gone - a shot intruder, say, goes down with a bullet in the leg - the self-defence argument ends.

"The law says that you have to stop the moment that you have repelled an attack, so normally one shot will suffice," said Steven Tuson, a professor of criminal law at Johannesburg's Wits University.

If Pistorius's lawyers choose to avoid the self-defence avenue, another option may be to argue temporary insanity based on chemical stimulants, a defence irreverently referred to in sports-mad South Africa as "roid rage", short for 'steroid'.

This is why Pistorius was taken for blood tests immediately after the shooting, Tuson said, "to exclude that defence". Classen also said the "roid rage" defence could only succeed in "extraordinary circumstances".

One other possible avenue is for Pistorius to argue "putative self-defence" - that he thought he was being attacked even if he wasn't. Even then, Classen said the content of the media reports, if true, curtailed his chances of success.

"The facts of the matter - and I caution again because I am only reading them from the media - suggest something totally different," he said. (Reporting by Ed Cropley; Editing by Michael Roddy)

Source: http://news.yahoo.com/pistorius-murder-defence-team-faces-few-options-181610015--sector.html

beltane capitals john edwards conocophillips octomom dan savage new world trade center

The zombiepocalypse has long been fertile ground for video game developers. The popularity of The Walking Dead TV series, which was spawned from the comic series and also led to last year's video game of the same name (and which took out our 2012 Game of the Year), has thrust the undead into the spotlight once again. Ubisoft is keeping the undead-bashing good times rolling with ZombiU, a first-person survival horror launch title for the Wii U.

ZombiU begins with you awakening from a dazed slumber to discover that the fair city of London is overrun by the undead. You must find somewhere safe to hide and gather your bearings. Just when all seems lost and you are faced by dozens of flesh eating zombies, you hear a voice over the public address system and are given instructions to nip down a nearby train station tunnel.

From here the game proper begins and you are guided by an unseen assistant as you first make your stronghold safe and then begin clearing the surrounding shops and tunnels of shambling killers.

ZombiU is a thrilling game. The sense of terror and stress as you battle seemingly overwhelming odds on a minute by minute basis, is exhilarating. The game also cleverly exploits the new features of the Wii U controller's touch screen. Indeed, the controller's unique design is pivotal to the gameplay. As play unfolds, your in game character finds a similar looking device. You then use this as an all purpose scanner in a virtual sense ?in the game,? which is a neat idea.

ZombiU uses the Wii U controller at least as well as any game currently out there, and the device helps add to the tension during gameplay too. The moments when you are looking at the screen on your controller while trying to solve a problem, can often be punctuated by an unwelcome assault, as a zombie lurches out of the darkness towards your character. This is exciting stuff and you will find that the game is even more of a heart starter if you dare play it with the lights low and the volume high.

The interface is for the most part solid too, even if the way you can aim your Wii U controller at the screen to scan areas for useful clues is at times awkward and inaccurate. The WiiiU controller?s motion tracker works reasonably well, but its sensitivity could have been more precise, particularly when scanning objects that are closer. The sniper rifle is actually easier to use, but for the scanning of the immediate area, it is better to just use the joystick and aim the old school way.

One major annoyance when using the Wii U controller as a scanner is that you cannot invert the vertical axis aim control, even if you have done just that for normal gameplay. This is inconsistent and frustrating. The inventory system works well, though, as does the mapping system, complete with instant access shortcuts to previously visited areas.

The game also rations your light, in that you have a torch battery that is limited by a timer count down. You can only have the light on for a certain time before the battery is depleted and you are left in darkness. Thankfully, this battery seems to exist outside of the current laws of physics, as it automatically recharges once switched off, giving you a permanent light source. That said, the way you can only use it for finite periods of time adds to the tension.

You will soon realize that shooting isn't always the best solution to your predicament, as there are times when you simply don't have enough ammunition to easily dispatch all of the zombies ? and ammunition is also noisy, which attracts unwanted attention.

Instead you get to smash the undead's brains out with a cricket bat (you are in England after all). The "wonderful willow" comes in for a lot of use and learning how to regularly hit the zombies for six is a skill you will have to master, as timing is everything. Sometimes you will have to use the bat to "bunt" and fend off attackers, so you can create some space and then smash them one at a time as they continue their relentless assault.

To some this may feel repetitive, but you are always belting zombies in new areas and with a fresh quest in mind. There are also plenty of different looking zombies and some, like the "dark" zombies or soldiers are tougher opponents, so there is variety there.

The game even repopulates previously cleared areas just to keep you on your toes. In true "survival horror" tradition, you will almost never feel settled. This is aided by the soundtrack, which is full of eerie moans and classic horror movie shocks. The sound of your character's breathing is also used well, coming short and fast when the action is on.

While the visuals aren't quite as stunning as the Wii U's power would suggest they could be but the dank, disgusting and unpleasant locations still impress. The game does suffer from minor glitches on rare occasions, the most annoying of which saw our character getting stuck in a wall ? we had to reboot the game and begin anew from the last save point.

One interesting design feature is the way your "death" is handled in game. As you play your way through, you will routinely get mobbed and will inevitably succumb to the zombie hordes. ZombiU deals with this situation very cleverly. The game avoids the cliche of just having you magically respawn, instead your current character really does "die" and you pick up play as a completely new character, with a fresh name, occupation, appearance and identity ? but with all the knowledge of your old character. The extra twist is that you must now kill the previous player character, who has sadly succumbed and has now joined the zombie hordes.

One problem we encountered with this fresh approach to death is that you can't always find the full inventory of items you know they were carrying. The game does respawn essential mission specific items, but you do just seem to lose some other stuff. And if you die again before you kill your previous player character, then all is lost as there can only be one zombie you (or zombieU) at a time.

By keeping track of how long you?ve managed to stay alive in your various incarnations, the game also provides an incentive to better your previous efforts ? or beat you friends with results uploaded to online leaderboards. Beating the main game also unlocks a permadeath Survival Mode, which gives you just one life to complete the game.

There are also a number of multiplayer modes that offer a markedly different experience to the single player campaign. Melee combat has been removed and the pace has been noticeably stepped up with faster reload times that reflects the multiplayer modes' gun-centric approach.

Playing as the human survivor or zombies is also handled in an interesting way, with the zombie controller playing in a "top down" view and spawning abominations left, right and center. To make for a fairer fight, zombies can't be placed right on top of the human player, who has a red ring of safety surrounding them and battles these hordes using the normal first person view. The zombie controller can't simply drown the human player in a sea of zombies either, as they have to be "bought" using replenishing resources, which adds a welcome strategic element to the game.

Ubisoft call this approach an "asymmeteric multiplayer" game because the two players are competing against each other, while playing what are two very different games. The human survivor is playing the game as a traditional shooter while the "zombie king" is spawning zombies and essentially playing a strategy game with the aim being the annihilation of the survivor.

Players use this mechanic in a capture the flag Assault mode, a Killing box mode that awards a score based on the number of kills, and a Survival mode, in which the human player must survive for as long as possible.

The multiplayer and single player campaign are so different that someone who might have found the campaign's reliance on melee combat repetitive and the controls too slow, will thoroughly enjoy the muliplayer options. However, it should be noted that ZombiU's multiplayer is limited to local play, with no online option available.

On the Wii U, ZombiU is one hell of an engrossing survival horror game. Not only is it very different from the other current Wii U titles, it uses the new console's technology well and it is a heck of a lot of fun, too. The remarkably mixed reviews for ZombiU are proof that the game isn't for everyone ? particularly if "running and gunning" is more your style ? so this is a game you might want to try before you buy.

Images courtesy of Ubisoft

Source: http://www.gizmag.com/zombiu-wiiu-review/25888/

virginia tech emancipation proclamation april 16 tornadoes mitch hedberg secret service scandal shea weber

CHICAGO (AP) ? A well-known Illinois state senator dropped her bid Sunday for the U.S. House seat vacated by Jesse Jackson Jr., narrowing the field and consolidating key support behind another Democrat in a race where gun control has emerged as a central issue.

State Sen. Toi Hutchinson, targeted in recent days by critical anti-gun campaign ads funded by New York Mayor Michael Bloomberg's political action committee, said she was leaving the race and swinging her support to former state Rep. Robin Kelly. The major shake-up came with just nine days to go before the Feb. 26 primary.

Hutchinson's move reflected the sharp divisions over the gun control issue, but also appeared to be in line with efforts to consolidate support for one of the many black candidates in the black-majority district. Community leaders had expressed concerns that the black vote could be split, thus boosting the chances of former U.S. Rep. Debbie Halvorson, a white candidate whom Jackson defeated in last year's primary battle.

"I am simply unwilling to risk playing a role going forward that could result in dividing our community at time a when we need unity more than ever," Hutchinson said Sunday in a written statement. "In the wake of horrendous gun related crimes all across our country, I agree with Robin that we need to stand together to fight gun violence."

Bloomberg's super PAC, Independence USA, has run ads in the district that target Hutchinson for her past opposition to tougher gun restrictions ? one of the campaign's most pressing issues along with economic hardships such as joblessness and foreclosures.

In a district encompassing parts of Chicago's South Side that have been deeply affected by gun violence, Hutchinson campaigned on more moderate views, saying the December school shooting in Newtown, Conn., brought about a change of heart.

Kelly, too, was among those criticizing Hutchinson's previous position and questioning whether her newfound stance was genuine. Now, Kelly says she's pleased to have her former rival's backing.

"In Congress, I will work with Sen. Hutchinson ... and other leaders throughout our district to get guns off our streets and bring jobs to our neighborhoods," Kelly said in a statement.

With Hutchinson's departure, the race is down to three top Democratic contenders: Kelly, Chicago Alderman Anthony Beale and Halvorson. The primary will likely decide the race because the district is so overwhelmingly Democratic.

Illinois' 2nd district also has a majority of black voters, even after boundaries were redrawn to include rural areas where there are greater numbers of white voters and where Halvorson is from.

Halvorson said Sunday that she believes she can easily woo those who had supported Hutchinson. She said in an interview that she was surprised by the sudden withdrawal and questioned what was behind the decision.

"There's no way that she would get out of the race unless she was told that she had no choice," Halvorson told The Associated Press. "And now what kind of deal was made? What is she going to get out of it? And I think everybody should come clean. ... This district is tired of wheeling and dealing."

Hutchinson's campaign did not respond to requests for comment.

Kelly told the AP that as far as she was aware there were no backroom negotiations or political deals made and that Hutchinson's decision was hers alone. She also does not think the ads by Bloomberg's PAC were any kind of tipping point in that decision.

Kelly defended the New York mayor's right to weigh in on an election in Illinois with ads endorsing her on the gun control issue and attacking her opponents.

"It's still up the people who go into the booth and vote," Kelly said in a phone interview. "But I think those ads counterbalance the millions of dollars that the NRA (National Rifle Association) has spent to influence what they want to influence."

Halvorson also has been targeted by the Bloomberg PAC ads because of her opposition to an assault weapons ban. She bristled at the notion of Bloomberg wading into the election.

"He's got billions of dollars, he has always been very controlling and he wants to control a congressional seat," she said.

Halvorson supports background checks for gun purchases and registration of all firearms but opposes an assault weapons ban, saying law-abiding gun owners have Second Amendment rights and that a ban in Cook County hasn't prevented gun violence.

The special election was triggered by Jackson's resignation in November. Jackson faces a federal conspiracy charge for allegedly spending $750,000 in campaign money on personal expenses. He also was recently diagnosed with bipolar disorder.

Source: http://news.yahoo.com/hutchinson-exits-race-jacksons-us-house-seat-154818268--election.html

kyle williams florida debate rand paul mark kirk florida gop debate freddie mac kristin cavallari

Rare tiger born in San Francisco Zoo is the first since 2008. Such zoo births are rare, and there are few as 400 Sumatran tigers left in the wild. This cub was born to a 9-year-old tiger, named Leanne.

By Laila Kearney,?Reuters / February 15, 2013

A Sumatran tiger named "Leanne" is shown sleeping beside her newborn cub at the San Francisco Zoo. The cub was born this past weekend.

REUTERS/San Francisco Zoo/Handout

EnlargeA Sumatran tiger gave birth to an apparently healthy cub at the San Francisco Zoo over the weekend in a rare boost to the critically endangered subspecies, zookeepers said on Thursday.

Skip to next paragraph' +

google_ads[0].line2 + '

' +

google_ads[0].line3 + '

Subscribe Today to the Monitor

Click Here for your FREE 30 DAYS of

The Christian Science Monitor

Weekly Digital Edition

There are estimated to be as few as 400 Sumatran tigers in the wild, and zookeepers were monitoring the pair in the zoo's secluded Lion House via webcam to allow the 9-year-old mother, named Leanne, and baby to bond with little human interference.

"All signs seem to be positive so far," said Corinne MacDonald, San Francisco Zoo curator of carnivores and primates.

"Mom and cub are bonding," she said, adding the cub appeared to be healthy and was active and eating a lot.

The unnamed cub was the first tiger born at the San Francisco Zoo since 2008, when Leanne delivered a litter of three males. The cubs were transferred to zoos across the United States. Before 2008, the zoo had not had a tiger birth in 30 years.

Zoo staff will not know the gender of the newborn until its first examination at least two weeks from now.

"These births are definitely rare," said Dr. Tara Harris, a tiger specialist with the North American accrediting group Association of Zoos and Aquariums. About 75 Sumatran tigers are in captivity in North America and give birth to two to four litters a year, she added.

The cub, which will stay at the zoo for a year and a half before zookeepers decide whether to transfer it, was fathered by a 6-year-old tiger named Larry, who was temporarily transferred from the Audubon Zoo in New Orleans for breeding.

Leanne was one of a handful of tigers worldwide to receive prenatal sonograms and exams while awake. Captive tigers are generally put under during the pregnancy exams, which can be dangerous to the mammals.

"It's so much better for these animals not to have to be sedated. Many animals have adverse reactions to the anesthesia, which can be worse than the actual procedure," MacDonald said.

In the wild, Sumatran tigers - the smallest of six tiger subspecies - are found only on the Indonesian island of Sumatra in lowland and mountain forests. Habitat destruction and poaching are the main reasons for the tigers' endangerment. (Editing by Cynthia Johnston and Peter Cooney)

Source: http://rss.csmonitor.com/~r/feeds/science/~3/wVaCtIRiAJE/Rare-tiger-born-at-San-Francisco-zoo

susan powell megamillions winners university of louisville louisville ky final four lotto winners mega ball winning numbers

JERUSALEM (AP) ? Former Foreign Minister Avigdor Lieberman went on trial Sunday on fraud and breach of trust charges, pleading innocent in a case that could have deep implications for the makeup of Israel's next government.

Lieberman, the leader of the ultranationalist Yisrael Beitenu Party and a key ally of Prime Minister Benjamin Netanyahu, is accused of trying to advance the career of a former diplomat who relayed information to him about a separate criminal investigation into Lieberman's business dealings.

The outcome of the trial will determine whether the hardline Lieberman will be able to return to the Israeli Cabinet or whether his fast-rising political career will come to a premature end.

Lieberman's Yisrael Beitenu ran on a joint list with Netanyahu's Likud Party in a parliamentary election last month. Their combined bloc emerged as the largest faction in the legislature and is expected to be the dominant member of the next ruling coalition. Netanyahu is still negotiating with potential coalition partners.

Lieberman has made clear that he wants to return to the Foreign Ministry, but he is barred from serving in the Cabinet while he is on trial. He has said that if he's convicted, he will resign from parliament. Depending on the severity of the conviction, Lieberman could be barred from seeking office again for years to come. In the meantime, he is allowed to serve in parliament.

The situation has put Netanyahu in a delicate position. With the trial expected to last well into the spring, it is not clear whether Netanyahu is willing or able to hold open the important foreign minister's job for his political ally. If he offers the post to another party, however, his alliance with Lieberman could become strained.

Lieberman and his Yisrael Beitenu faction have accumulated tremendous political power, and he is a key player in the governing coalition Netanyahu is now trying to form. Many speculate he is preparing for a run as prime minister in future elections.

Netanyahu has been serving as acting foreign minister while he puts together a new coalition. He has until mid-March to form the government.

Lieberman showed little emotion as he arrived at the Jerusalem courthouse on Sunday. His lawyers said they would seek a quick resolution to the case. The trial is scheduled to last until May at the least.

The Soviet-born Lieberman is one of the most contentious and polarizing figures in Israeli politics. Yisrael Beitenu is especially popular among immigrants from the former Soviet Union. With a tough-talking message that has questioned the loyalty of Israel's Arab minority, criticized the Palestinians and confronted Israel's foreign critics, he has at times alienated Israel's allies while becoming an influential voice in Israeli politics.

Lieberman pushed a series of legislative proposals that critics said were anti-Arab, including a failed attempt to require Israelis to sign a loyalty oath or have their citizenship revoked. He also embarrassed Netanyahu in the past by expressing contrasting views to that of the government, including skepticism over the chances of reaching peace with the Palestinians.

Lieberman was largely sidelined in Israel's dealings with the United States. Netanyahu himself or the outgoing defense minister, Ehud Barak, usually handled ties with Washington instead.

Former Deputy Foreign Minister Danny Ayalon, who was unceremoniously dropped from Lieberman's faction list just weeks before elections and who will likely testify against Lieberman in his trial, was quoted by the Maariv daily as saying that Lieberman is unsuited to serve as the nation's top diplomat because he did not win the international community's trust.

"If after four years of service this is the result, he should go for the Finance Ministry post," Ayalon was quoted as saying.

Source: http://news.yahoo.com/israel-ex-foreign-minister-trial-fraud-155859700.html

Dave Grohl 121212 Cal State Fullerton Pacific Rim tumblr Ravi Shankar Geminid meteor shower

Investing in a Low-Growth World

John Mauldin

February 16, 2013

?

The jury ? unless you are the Fed and Ben Bernanke or the Congressional Budget Office, which cannot make lower growth assumptions without really blowing their deficit projections out of the water ? is pretty well in on GDP growth: it?s going lower. Ed Easterling and I wrote a recent Thoughts from the Frontline on multiple pieces of research suggesting slower future growth. We asked the question, ?So what about stock prices; will they follow suit?? Our thought was that, over time, they would.

Not so fast, says Jeremy Grantham in today?s Outside the Box. He was part of the cabal of researchers suggesting slower future GDP growth whose work we used as the basis for our analysis. Longtime readers know that I think Jeremy Grantham (who heads GMO, which now manages $106 billion ? see GMO LLCfor more wonderful GMO team research) is one of the smartest men on the planet as well as one of the best investors. With his usual thoroughness, Jeremy makes the case, based on in-house research, that both stock-market returns and corporate earnings growth are negatively correlated to GDP growth. At the same time, he?s not overselling his thesis:For the record, there is also: a) a moderate relationship between higher-priced countries (on Shiller P/E and price/book) and future underperformance; and b) a tendency for more rapidly-growing countries to be overpriced. Therefore we can deduce a logically appealing (but statistically weak) tendency for overvaluation to contribute a second reason for the market underperformance of more rapidly growing countries. (Please notice how carefully said that is.)

He goes on to reiterate important points he has made over the past few months about the effect of growing resource costs on growth, and then adds:

The main new point I wanted to make was that resource costs are treated like GDP increases. Hence, prior to 2002, steadily falling resource costs were treated as a debit when of course steadily lower costs were a great help to well-being and utility. We calculated that adjusted GDP actually grew 0.2% a year faster than stated. Conversely, since 2000, rising costs were a detriment, not a benefit, as shown in GDP. Treated correctly as a negative, resource costs would have reduced real growth by 0.4% a year. This squeeze on growth will continue as long as resource costs rise faster than the growth rate of the balance of the economy.

Always careful of the ground he stands on, Jeremy then throws in a very important caveat to say:? it is worth remembering that we don?t really know what caused resource prices to spike from 2002 to 2008 so impressively. This was a much bigger price surge than occurred during World War II! Indeed, it may easily turn out that the resource price rises will squeeze future GDP growth substantially more than our estimates.

Or not.

In any case, a careful reading of Jeremy?s work is always instructive. This one is an important think piece, as the direction and magnitude of future GDP growth will be critical as we make business, retirement, and investment decisions. Simply talking past performance is risking your future on the unlikely prospect that the future will look like the immediate past.

I am personally doing a lot of thinking and research on this topic. I strongly suspect that other significant factors will arise to play havoc with projections, in both fantastically positive and uncomfortably dire ways. I am more and more seeing the future as very ?lumpy,? that is, quite uneven as to how it will affect individuals and even entire countries. For those who espouse more equality in incomes and outcomes, this is not your optimal scenario. But even with all the ?lumpiness,? the average person will be much better off in 20 years ? though ?average? will cover a much wider spread of outcomes than it does even today. But rather than launch into that book now, we?ll let Jeremy take over.

Have a great weekend. I am enjoying being at home this week. I will be in Palm Springs at the California Resource Investment Conference, February 23-24. My good friend Grant Williams, who writes the blockbuster Things that Make You Go Hmmm? and the Mauldin Economics? Bull?s Eye Investor letter, will be there, as will the best resource investor I know, Rick Rule, along with my favorite data maven, Greg Weldon. There is a full two-day slate of speakers. The event is free to investors and is always fun, and it?s a great time of year to be in California (hate the pensions, love the weather). Come see us! You can read all about it and register at the Cambridge House website.

Your looking forward to catching up this weekend on my reading analyst,

John Mauldin, Editor

Outside the Box

By Jeremy Grantham

This quarter I will review any new data that has come out on the topic of likely lower GDP growth. Then I will consider any investment implications that might come with lower GDP growth: counter intuitively, we find that investment returns are likely to be more or less unchanged ? a little lower only if lower growth brings with it less instability, hence less risk. Finally I will take a look at the reaction to last quarter?s letter, specifically about my outlook for lower GDP growth.

Recent Inputs on a Low-Growth Outlook

Some information came out after the 4Q 2012 Letter or was missed by us and is worth mentioning. First, the Congressional Budget Office slashed its estimate of the U.S. long-term growth trend from 3.0% to 1.9%! Given the source and the magnitude of the adjustment, I think it is fair to say that their number is ?close enough for government work? to our 1.5%. At least it is within negotiating distance. Next, a report from Chris Brightman of Research Affiliates actually came out a week before ours and concluded that long-term GDP was 1.0%, a number that really corresponds to our 1.5% because his report has no reference to our two special factors, resources and climate, which take our 1.5% to 0.9%. I was encouraged by the solidness of his research. It also led me to an article in the Financial Analysts Journal (January-February 2012) by Rob Arnott and Denis Chaves. Rob has been writing about the effects of age cohorts on investment returns for almost as long as I can remember, with the central idea that older people are sellers of assets ? houses as well as stocks ? that younger members of the workforce buy. But they also include the aging effect on GDP growth, which he shows taking a real hit in all developed countries (except Ireland). They are commendably careful in suggesting that their model may be wrong. When or if you read this article, you will certainly hope that it is indeed wrong, for their models estimate from past experience a far greater drop in GDP growth than our work assumed last quarter. And they certainly attacked that aspect in far greater detail than we did. We had included in our report the effect of aging on the total percentage of the population of working age: there are simply fewer workers and more retirees in the distribution. But Rob and Denis (sorry for the liberty) introduce the incremental idea, apparently provable, that older workers lose productivity, no doubt much more in heavy manual work than, say, in writing this. But definitely alas, including all activities with dire consequences, they argue for productivity and GDP growth.

Would Lower GDP Growth Necessarily Lower Stock Returns?

This is where I break ranks with many pessimists because I believe theory and practice strongly indicate that lower GDP growth does not directly affect stock returns or corporate profitability. (At least not in a major way for, as we shall see later, there may be some indirect or secondary effects that may very modestly lower equity returns.)

All corporate growth has to funnel through return on equity. The problem with growth companies and growth countries is that they so often outrun the capital with which to grow and must raise more capital. Investors grow rich not on earnings growth, but on growth in earnings per share. There is almost no evidence that faster-growing countries have higher margins. In fact, it is slightly the reverse.

For there to be a stable equilibrium, assets, including entire corporations in the stock market, must sell at replacement cost. If they were to sell below that, no one would invest and instead would merely buy assets in the marketplace cheaper than they could build themselves until shortages developed and prices rose, eventually back to replacement cost, at which price a corporation would make a fair return on a new investment, etc.

The history of market returns completely supports this replacement cost view. The fact that growth companies historically have underperformed the market ? probably because too much was expected of them and because they were more appealing to clients ? was not accepted for decades, but by about the mid-1990s the historical data in favor of ?value? stocks began to overwhelm the earlier logically appealing idea that growth should win out. It was clear that ?value? or low growth stocks had won for the prior 50 years at least. This was unfortunate because the market?s faulty intuition had made it very easy for value managers or contrarians to outperform. Ah, the good old days! But now the same faulty intuition applies to fast-growing countries. How appealing an assumption it is that they should beat the slow pokes. But it just ain?t so. And we at GMO have (somewhat reluctantly for competitive reasons) been talking about it for a few years.

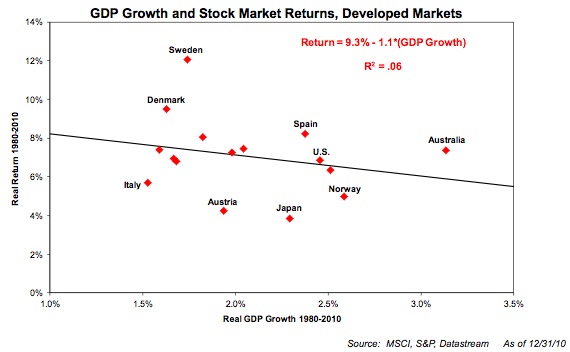

Exhibit 1

GDP Growth Unrelated to Stock Returns

GDP Growth Unrelated to Stock Returns

?

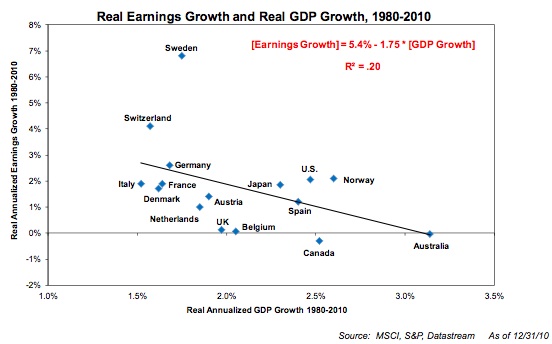

Exhibit 1, shown by us before, shows the moderately negative correlation between GDP growth by country along with their market returns. This is shown for the last 30 years only and for developed countries only, but in earlier work we went back a hundred years for some developed countries and looked at emerging country equity markets as well and all had the same negative correlations. (See Ben Inker?s white paper, ?Reports of the Death of Equities Have Been Greatly Exaggerated: Explaining Equity Returns?, August 10, 2012, at www.gmo.com [registration required].) When I asked my colleague Ben Inker if this was for the same reason that growth companies underperform ? that they are overpriced ? Ben came up with another completely sufficient explanation (in about 10 seconds): the faster-growing countries, at least for the last 30 years, have simply had more slowly-growing earnings per share. This is shown in Exhibit 2. For the record, there is also: a) a moderate relationship between higher-priced countries (on Shiller P/E and price/book) and future underperformance; and b) a tendency for more rapidly-growing countries to be overpriced. Therefore we can deduce a logically appealing (but statistically weak) tendency for overvaluation to contribute a second reason for the market underperformance of more rapidly growing countries. (Please notice how carefully said that is.)

Exhibit 2

Earnings Growth Is Negatively Correlated with GDP

Would Lower Real Rates Lower Stock Returns?

Economic theory can?t get everything completely wrong, and perhaps one thing economists have gotten partly right is that the risk-free rate has some relationship to the growth rate of the economy. If that rate approaches zero, there is clearly less demand for new capital; in fact, given accurate depreciation accounting, there would be zero net new capital required. It is also easy to see the risk-free rate settling at something around nil. The risk premium, however, might be little affected. The demand for risk capital ? e.g., to replace an old plant, resulting in no new net growth ? would still require that the investor expect an adequate return. If it looked likely to be less than that, he would of course withhold his capital until inevitable shortages pushed up profits enough for the corporation to get a satisfactory return, as we have often discussed.

However, and I bring up this complicated issue with trepidation, it does seem possible that in a world with both lower growth and a lower risk-free rate that the risk premium might also drop a little. A lower growth world might plausibly be less volatile because managing a world where the apparent growth is 1.5% (and real growth is 0.9%) is likely to be easier to stabilize than one (as from 1870 to 1995) appearing to grow at 3.4% but actually growing at 3.6%, almost four times higher. (Another way of stating my negative 0.5% resource adjustment, by the way, is to say that the economy?s costs are growing at 1.5% but that its utility ? or something closer to utility than GDP anyway ? is only growing at 0.9%.) If returns to equity holders are to fall, then P/Es must paradoxically rise to bring yields and total returns down. Yet, as always, equities have to sell at replacement cost. Therefore the books have to be balanced by returns on equity falling. This after all seems reasonable ? if returns on T-Bills drop and returns to stockholders drop, then a system in balance would suggest that returns on corporate investment also drop. This adjustment would likely be modest and should only occur if a lower-growth world were to become less likely, which is far from certain, merely plausible.

Reflections on Our Work on Lower-Growth GDP

With a few months to reconsider the data, old and new, I would have framed last quarter?s issue on declining growth differently to emphasize how routine, even friendly, most of our inputs were. The main new point I wanted to make was that resource costs are treated like GDP increases. Hence, prior to 2002, steadily falling resource costs were treated as a debit when of course steadily lower costs were a great help to well-being and utility. We calculated that adjusted GDP actually grew 0.2% a year faster than stated. Conversely, since 2000, rising costs were a detriment, not a benefit, as shown in GDP. Treated correctly as a negative, resource costs would have reduced real growth by 0.4% a year. This squeeze on growth will continue as long as resource costs rise faster than the growth rate of the balance of the economy. Further, as the percentage of the GDP taken up by resources has recently more than doubled (2002 to 2012), the squeeze on the balance of the economy would also be doubled even if the rate of cost increases stayed constant. Last quarter I estimated that continued increases in resource costs from now to 2050 would lower GDP growth by 0.5%. To prevent that 0.5% effect from accelerating as the share of resources in GDP rises, the rate of resource cost increases must decelerate from the recent 7% a year to a much more modest 2% a year by 2050. (By then, of course, it might well be over the current 7% ? it is just not knowable.) As one can see, this is not nearly as draconian an assumption as it might initially appear to be and in this context it is worth remembering that we don?t really know what caused resource prices to spike from 2002 to 2008 so impressively. This was a much bigger price surge than occurred during World War II! Indeed, it may easily turn out that the resource price rises will squeeze future GDP growth substantially more than our estimates.

Although our low estimate of future GDP growth attracted attention and plenty of opposition, it was only produced as a necessary backdrop to show the potential significance of our two new points: the large deduction for a cost squeeze from resources (0.5%) and a very slight but increasing squeeze from climate damage (0.1 rising to 0.4 after 2030), which latter deduction is considered almost ludicrously conservative by that handful of economists that study the costs of climate change. Our work on the traditional aspects of GDP growth was approached by us as a necessary chore; we were not looking for trouble. Consequently, we tried to keep it simple by using the obvious data sources. ?Where on earth did GMO get its pessimistic population data?? ran one complaint. Well, would you believe the U.S. Bureau of Census? And as for productivity, we extended the 1.3% average for the last 30 years out for 30 more years. This is clearly a very friendly assumption given: a) the recent 1.3% in productivity growth of the last 30 years had declined a lot from its 40-year surge of 1.8% after World War II; and b) the fact that the segment of much higher productivity ? manufacturing ? has declined to a mere 9% of total labor from 19% in 1980 and continues to decline. Even my one override, -0.2% a year for the next 18 years as a result of much-reduced capital spending, seems, based on econometric modeling, to be a very modest debit. For there to be so modest a negative effect needs capital spending to drift back toward normal in the relatively near future. And even then this -0.2% effect was exactly offset in our forecast by a +0.2% bonus for the unanticipated surge in fracking activity and the ensuing burst of momentarily cheap energy. So why the fuss? The resource debit merely reflects the remarkably odd GDP accounting that counts an unfortunate surge in necessary costs as a benefit, and the remaining 1.5% is merely reflecting recent data. Higher growth assumption, Mr. Bernanke should be aware, must prove longer-term improvements in productivity or, tougher yet, increased labor input.

Short-Term Behavioral Impacts on the Market from Lower GDP

Of course, in the short term there are always temporary behavioral responses. If GDP growth drops unexpectedly, corporations might easily be caught mis-budgeting or overexpanding (although this current ultra-cautious U.S. corporate system, which only reluctantly makes capital investments, is unlikely to be caught out too badly), and perhaps more importantly investors may be shocked by continuous revenue warnings, which might cause the market to sell off. Recent corporate announcements, while usually still claiming exceptional profit margins and generally hitting earnings targets, are increasingly missing revenue targets and issuing future revenue warnings. We must admit, though, that recent revenue warnings have not stopped the market from rising, nor has the unexpectedly slightly negative growth for the fourth quarter GDP.

Within sectors there would quite likely also be a shift in preferences. Growth stocks might seem relatively more attractive: ?If the system isn?t growing, the least I can do is pick a few companies that clearly are still growing.? Perhaps quality franchises would also become more appealing with the logic being that at least in the transition to lower top-line revenue growth, competition would become more severe and, hence, defensive moats even more than usually desirable.

Engineered Low Interest Rates

The Fed?s negative real rates regime, designed to badger us into riskier investments in order to push up equity prices and grab a short-term wealth effect (that must be given back one day when least comfortable and least expected), has gone on for a long and, for me, boring time. This low interest rate period is serving, therefore, as a sneak preview of what a permanently lower rate regime might look like (although any permanently lower rates reflecting lower GDP growth would be by no means as low as these engineered rates that we are currently experiencing). So what are some of these effects? The artificially low T-Bill rates first work their way slowly up the curve. Next, the most obviously competitive type of equities ? high yield stocks ? begin to be bid up ahead of the rest of the market, as has happened. ?I?ve just got to squeeze out some higher rates somewhere, anywhere,? is the pension fund plea. Then, this low rate competition begins to filter into other securities, historically sought after for their higher yields: higher-grade real estate, where the ?cap rates? slowly fall; and, unfortunately, also forestry and farmland, mainly of the larger and more standard varieties that appeal to institutions, which show declines in their required yields, i.e., their prices rise. The longer the engineered rates stay below true market rates, the higher asset prices become until, yes, you?ve got it, corporate assets begin to sell way over replacement cost. Then, if the heart of capitalism is still beating at all, a long period of over-investment begins and returns are bid down and everything moves into balance, often helped along if asset prices get too high, as in 2000 and 2007, by a good healthy market crunch. (This strategy will be seen in future years as archetypical of the Greenspan-Bernanke era: badger and bully investors into taking more risk and eventually pushing assets ? houses or stocks or both ? far over replacement value, followed eventually, at long and hard-to-predict intervals, by exciting crashes. No way to run a ship, but it does produce an environment that contrarians like us, who can take a few licks, can thrive in.)

Stock Option Culture Messes Things Up

The normal capitalistic response described above runs smack into the new tendency for corporations to either sit on money or buy stock back (regardless of how expensive it may be!), which works in the opposite direction to create shortages, drive prices up, and, as a by-product, lower job creation and GDP growth. So where does this all come out? You tell me. All that I know is: a) if we in the U.S. don?t invest, others will and it will, in the longer run, definitely end badly; b) that even if there is a lower-return world in the future it is still better to own the cheaper assets; and c) it behooves buyers of ?cap rate? type assets like real estate to realize that the current low rates are flattered by current Fed policy, which will, like everything else in life, pass away one day, leaving them looking overpriced. It can?t be too soon for me. In the meantime for us at GMO it means emphasizing care and maintaining a heightened sense of value discipline, not only in stock selection, as the whole world is once again bid up over fair value in a way so typical of the post 1994 era, but also in forestry and farmland. GMO has investments in those areas too and recognizes the need to sidestep overpricing by emphasizing the nooks and crannies. Fortunately there are more nooks and deeper crannies in forests and farmland than there are in almost any other area, certainly including stocks.

Danger of the Fed Overestimating Growth

This doesn?t really fit in with a quarterly letter emphasizing important good news, but being about the Fed, I have to make an exception. The Fed appears to be still assuming a 3% growth rate for future U.S. GDP. It would be safer and more confidence-inspiring, now that Bernanke appears to take his responsibility for growth seriously, that he at least have a reasonable growth target (preposterous as that notion is to me that the Fed should or even could affect long- term growth simply by messing about with interest rates). The growth in available man-hours has definitely declined by about 1% a year, yet Bernanke?s assumption for our GDP?s normal trend growth appears unchanged at its old 3%. Ergo, he must be assuming an offsetting rise of 1% in productivity. But why? We should treat these assumptions quite seriously for this is famously (for me) and painfully (for all of us) the man who could not see a 33?4-standard- deviation housing market, and indeed protested that all was normal, etc., etc., etc. (Dear handful of niggling readers, this 33?4-standard-deviation event is calculated on the assumption of a normal distribution, as is often done in investing, even though we [especially at GMO] know this is not true but is just a convenient statistical device. In fact, we at GMO know quite a bit more on this topic for we have studied more or less all assets for as long as we can find data and we have found a remarkable total of 330 ?bubbles,? 36 of which we call ?major, important bubbles,? which we define as 2-standard-deviation events, given the same assumption. Well, a 2-sigma event should occur every 44 years in a normally distributed world and they have occurred every 31 years. This is much closer to random than we had previously thought. Yes, financial asset data is fat-tailed; that is, there are more outlying events than are found in a normally distributed series, but they are not extremely fat-tailed. They show up as 2-sigma events but occur as often as 1.8-sigma events would occur in normal distributions. Extrapolating, we can assume that Bernanke?s 33?4-sigma housing bubble would occur, adjusted for our fat-tailed real-life history, not every 10,000 years, but somewhere more like 1 in 5,000 years! I previously used ?a 1-in-1,200-year event? as a casually selected very large number to describe the 2006 housing bubble. But under challenge, these current numbers are more accurate. No, this does not mean we have 10,000 years of data or even 5,000. It is just statistics, full as always of assumptions, which in this case we hope approach rough justice. What it does definitely mean, though, is that it was extraordinarily unlikely that the extremely diversified U.S. housing market would shoot up like it did and, frankly, even more remarkable that Bernanke and his timid or incompetent advisors could miss it. This is a doubly amazing miss because his and Greenspan?s policy caused this bubble in the first place!) In comparison, his willingness to target an unrealistic 3% level for GDP growth is statistically a microscopic error, a picayune mistake. Unfortunately, though, in the hands of probably the most influential man in the global economic world, it is an extremely dangerous one. I like the analogy of the Fed beating a donkey (the 1% growing economy) for not being a horse (his 3% growing economy). I assume he keeps beating it until it either turns into a horse or drops dead from too much beating! Fine-tuning economic growth, an impossible job for the Fed anyway, is hardly likely to get any easier by badly overstating trend-line growth. It seems nearly certain, therefore, that the Fed will keep trying to whack the donkey for far too long. The likely consequences of this policy are, to be frank, over my head, but my colleague Edward Chancellor will address them briefly if I can nag him effectively.

Investment Implications

Courtesy of the above Fed policy, all global assets are once again becoming overpriced. This reminds me of the idea sometimes attributed to Einstein that a workable definition of madness is constantly repeating the same actions but expecting a different outcome! But, as always, asset prices are not uniformly overpriced: emerging markets and, we believe, Japan are only moderately overpriced. European stocks are also only a little expensive, but in today?s world are substantially more risky than normal. The great global franchise companies also seem only moderately overpriced. Forestry and farmland, which is not super-prime Midwestern, is also only moderately overpriced but comes with our nook and cranny sticker attached. But much of everything else is once again brutally overpriced. Notably, U.S. stocks (ex ?quality?) now sell at a negative seven-year imputed return on our numbers and most global growth stocks are close to zero expected return. As for fixed income ? fugetaboutit! Most of it has negative estimated returns on our data, and longer debt, as always, carries that risk that may be slight in any period, but is horrific if it occurs ? accelerating inflation.

When one combines the apparent determination and influence of those who do the bullying with the career risk and short-termism of the bullied and the desire of the general public to believe unbelievable good news, these overpricings can go much further and the Fed can win another round or two. That?s the problem. A clue to timing would be when we begin to hear more passionate new era arguments: profit margins will always be higher; growth will snap back to 3% for the developed world; and new ones I can?t think of ? maybe ?when the discount rate is this low the Dow should sell at, perhaps, 36,000.? In the meantime, prudent managers should be increasingly careful. Same ole, same ole.

Source: http://www.ritholtz.com/blog/2013/02/investing-in-a-low-growth-world/

being human chicago news chicago news golden girls robert e lee golden globe winners the express

This page is only available to subscribers.

If you are already a subscriber, please log in below...

Lost password? Click hereIf you would like to register for a free trial to SparkSpread.com, click here

| Terms of use ??????? ? 2005-2006 SparkSpread.com All Rights Reserved ??????? Developed by: Oppenheimer ??????? Graphic Design: Uzi Dor |

Source: http://www.sparkspread.com/sparkspread.php?sparkspread_concept=story&id=12430

asante samuel salton sea arizona immigration law aubrey huff the killers julianne hough brandy

COLUMBUS, Neb. (AP) -- A Nebraska utility says the new route for a proposed oil pipeline that would carry Canadian crude oil through the state will delay work on electric transmission lines for the pipeline.

Nebraska Public Power District officials said they won't be able to build the transmission lines by the deadline TransCanada set for the end of 2014.

NPPD Chief Operating Officer Tom Kent said there's no way the transmission lines will be ready by 2015, the Columbus Telegram reported (http://bit.ly/12WrOrZ).

"We have a lot of work to do," he said.

TransCanada's proposed Keystone XL pipeline will carry Canadian crude to the Gulf Coast if it can win President Barack Obama's approval. The proposed $7 billion pipeline would cross Montana, South Dakota, Nebraska, Kansas, Oklahoma and Texas. TransCanada also has proposed connecting it to the Bakken oil field in Montana and North Dakota.

The southern section of the pipeline between Oklahoma and the Gulf Coast is already under construction, but TransCanada needs a presidential permit for the northern section because the pipeline crossed the U.S.-Canadian border.

TransCanada altered the pipeline's proposed path through Nebraska last year to avoid the environmentally sensitive Sandhills region and a couple towns' drinking water wells. Nebraska Gov. Dave Heineman recently signed off on the new route.

That new route forces NPPD to redo design and planning work for all the areas where the pipeline route changed. Officials estimated that could take 12 to 24 months to complete.

NPPD expects to spend $44 million on the transmission lines, but TransCanada will have to reimburse the utility regardless of whether the pipeline is ultimately built.

Environmentalists oppose the project because they worry the pipeline could contaminate groundwater reserves and threaten ecologically sensitive areas in Nebraska and other states along its 1,700-mile path.

Thousands of people attended a protest in Washington, D.C., on Sunday to urge Obama to reject the pipeline. The crowds marched from the National Mall to the White House.

Pipeline backers say the project will create thousands of jobs both in the construction of the pipeline and at refineries. Opponents say the pipeline won't create nearly as many jobs as TransCanada has projected.

Project supporters also say the project would give the United States a steady source of oil from a friendly neighboring country.

___

Information from: Columbus Telegram, http://www.columbustelegram.com

Source: http://news.yahoo.com/utility-says-pipeline-power-wont-183658253.html

project m colts colts big ten tournament 2012 dennis quaid bruce weber fired notorious big

MOBILE, Ala. (AP) ? After a week at sea, much of it in conditions described as filthy and not at all the luxury cruise touted in brochures, most passengers aboard the crippled Carnival Triumph will make it to shore Thursday night ? only to then face an hours-long bus ride or other travel hassles to finally get back home.

What began as a four-day voyage in the Gulf of Mexico has turned into a vacation nightmare, an odyssey that has relatives of passengers growing frustrated with the cruise line, wondering just how healthy and clean it is aboard the ship. The more than 4,000 people on board are likely growing irritated, too, but so far many of them have only spoken to relatives, complaining they have had little to no access to food and bathrooms since an engine-room fire disabled the ship Sunday.

When passengers arrive in Alabama, their stay will be short. Carnival said in a statement late Wednesday that passengers were being given the option of boarding buses directly to Galveston, Texas, or Houston ? a roughly seven-hour drive ? or taking a two-hour bus ride to New Orleans, where the company said it booked 1,500 hotel rooms. Those staying in New Orleans will be flown Friday to Houston. Carnival said it will cover all the transportation costs.

"I can't imagine being on that ship this morning and then getting on a bus," said Kirk Hill, whose 30-year-old daughter, Kalin Christine Hill, is on the cruise. "If I hit land in Mobile, you'd have a hard time getting me on a bus."

Hill is booking a flight from Amarillo, Texas, to New Orleans to meet his daughter when she gets there.

The ship was in sight of the Alabama shore about midday, but still had hours before it was docked. Television images from CNN showed passengers walking around the ship's deck, some of them waving to the helicopters flying above. People in boats, presumably officials from Carnival, the Coast Guard and Customs also had boarded the ship.

On board, passengers described people using plastic bags to go to the bathroom and waiting for hours to get food. Thelbert Lanier was waiting at the Mobile port for his wife, who texted him early Thursday.

"Room smells like an outhouse. Cold water only, toilets haven't work in 3 1/2 days. Happy Valentines Day!!! I love u & wish I was there," she said in the text message, which was viewed by The Associated Press. "It's 4:00 am. Can't sleep...it's cold & I'm starting to get sick."

Renee Shanar, of Houston, is on board the Triumph with her husband. In a text message to AP, she said that Carnival has told the passengers that they are delayed again "because of winds."

"We think they don't want media there," she wrote.

Shanar said conditions were "horrible" and there is food but bathrooms aren't flushing.

"People have gotten food poisoning. Old people have fallen and hurt themselves," she wrote in a text message.

The company has disputed the accounts of passengers who describe the ship as filthy, saying employees are doing everything to ensure people are comfortable. Vance Gulliksen, a Carnival spokesman also said the company chose to bus people to New Orleans because it "offered additional capacity and flexibility which was important to us."

Robert Giordano, whose 33-year-old wife Shannon is aboard the cruise liner with a group of friends of hers from Edmond, Okla., said he has yet to speak to someone at Carnival. All his information has come through pre-recorded phone calls, the most recent one Wednesday afternoon when he was told the ship would "probably" arrive in Mobile late Thursday or early Friday. He got better information, he said, when the "Today" show called him.

"A complete utter surprise to me. I'm excited but I didn't know about that," Giordano said. "That's the biggest frustration for me now is that the media knows more than the family members do and certainly more than the passengers do on the ship."

Gulliksen said the Triumph is now expected arrive in Mobile between 8 and 11 p.m. Thursday. He said the company has tried to keep families updated and established a toll-free number for friends and relatives. Gulliksen said about 200 Carnival employees are in Mobile waiting to assist passengers upon their arrival, and some will go on board to assist when the ship sails in.

The ship left Galveston for a four-day cruise last Thursday with 3,143 passengers and 1,086 crew members. The ship was about 150 miles off Mexico's Yucatan Peninsula when an engine room fire knocked out its primary power source, crippling its water and plumbing systems and leaving it adrift on only backup power.

No one was injured in the fire, but a passenger with a pre-existing medical condition was taken off the ship as a precaution.

In Mobile, officials were preparing a cruise terminal that has not been used for a year to help passengers go through customs after their ordeal.

Mobile Mayor Sam Jones questioned the plan to bus passengers to other cities, saying the city has more than enough hotel rooms and its two airports are near the cruise terminal.

"We raised the issue that it would be a lot easier to take a five-minute bus ride than a two-hour bus ride" to New Orleans, Jones said. Jones said Carnival employees will be staying in Mobile.

Carnival Cruise Lines has canceled more than dozen more planned voyages aboard the Triumph and acknowledged that the crippled ship had been plagued by other mechanical problems in the weeks before the engine-room blaze. The National Transportation Safety Board has opened an investigation.

Gulliksen said the Triumph's recent mechanical woes involved an electrical problem with the ship's alternator on the previous voyage. Repairs were completed Feb. 2. He said there was no evidence between the previous problem and the fire.

"We know it has been a longer journey back than we anticipated at the beginning of the week under very challenging circumstances," Carnival President and CEO Gary Cahill said. "We are very sorry for what our guests have had to endure."

Communication with passengers on the Triumph has been limited to brief windows when other cruise ships with working cellular towers have rendezvoused to deliver supplies.

Giordano said he last spoke to his wife, Shannon, on Monday. She told him she waited in line for three hours to get a hot dog.

"They're having to urinate in the shower. They've been passed out plastic bags to go to the bathroom," Giordano said. "There was fecal matter all over the floor."

Passengers are supposed to get a full refund and discounts on future cruises, and Carnival announced Wednesday they would each get an additional $500 in compensation.

Once docked, the ship will be idle through April.

___

Plushnick-Masti reported from Houston. Associated Press writers Bob Johnson in Montgomery, Ala., and Melissa Nelson-Gabriel in Mobile contributed to this report.

Source: http://news.yahoo.com/crippled-cruise-makes-way-alabama-shore-174651605.html

tcu dr. oz heart attack grill las vegas the heart attack grill joe kennedy iii joseph kennedy iii ghost hunters

By James Sullivan, Rolling Stone

One word. Near the end of "The Greatest Love of All," the third straight Billboard?No. 1 single for the 22-year-old Whitney Houston, the singer transformed the tone of the song from sweetly exalted to absolutely unstoppable. "No matter what they take from me, they can't take away myy! dig-ni-ty," she thundered on the second pass through the verse, distilling all the great gospel and soul legacy of her very talented family (mother Cissy Houston, cousins Dionne and Dee Dee Warwick, godmother Aretha Franklin) into a single syllable.

Kevin Winter / Getty Images

The co-author of the song, Linda Creed, wrote it about her own battle with breast cancer. After living with the disease for a decade, she died at age 36 in April 1986, a month before Houston's version hit the top of the charts. Houston was just getting started. Perfecting a definitively 80s brand of pop-soul -- smooth-jazz keyboards and rhythms, swelling orchestration?-- she was, for a good stretch, the brightest star in an era marked by super-duper-stars.

Though she had one of the most astonishing, confident voices pop had ever heard, she also had restraint, and she dealt with criticism that her style was airbrushed. "You're not black enough for them," she explained to Katie Couric in a 1996 interview. "You're not R&B enough. You're very pop. The white audience has taken you away from them." But Houston's voice was no appeasement, and the fact that she didn't push every line over the edge meant each of her songs contained a signature moment -- sometimes as fleeting as that "my dignity" -- when she vaulted the song into the realm of divine possession. When she was singing, she knew precisely what she was doing, always.

She hit the mark on the full-hearted pity party "All At Once," when she took the line "I looked around and found that you were with another love" up and up, like a dizzying hot-air balloon ascent. She did it on "All the Man That I Need," when her voice broke into a heart-stopping flutter on the last word of the line "He gives me more love than I've ever seen." She made patriotism sound like the greatest joy on earth with her resplendent version of "The Star-Spangled Banner." And the sustained note that centers her version of Dolly Parton's "I Will Always Love You"?-- "and Aaaaah-e-aye, will always love you" -- raises the song from a bittersweet memory to the power of existence itself.

Whitney Houston lived for the moment. Sadly, it eventually led to addiction, and the ravaging of her extraordinary voice. But if gospel music was created to express those moments of pure communion with your inner truth, then Whitney Houston was undoubtedly heaven-sent.

Related content:

powerball winner powerball winner Zig Ziglar lunar eclipse alabama football florida lotto dancing with the stars

UNITED NATIONS (Reuters) - The death toll in Syria is likely approaching 70,000 with civilians paying the price for the U.N. Security Council's lack of action to end the nearly 2-year-old conflict, the U.N. human rights chief said on Tuesday.

Navi Pillay, the U.N. high commissioner for human rights, repeated her call for Syria to be referred by the 15-member council to the International Criminal Court to send a message to both parties in the conflict that there would be consequences for their actions.

Pillay told a council debate on protection of civilians in armed conflict that the death toll in Syria was "probably now approaching 70,000."

On January 2 Pillay said more than 60,000 people had been killed during the revolt against Syrian President Bashar al-Assad, which began with peaceful protests but turned violent after Assad's forces tried to crush the demonstrations.

"The lack of consensus on Syria and the resulting inaction has been disastrous and civilians on all sides have paid the price," she said. "We will be judged against the tragedy that has unfolded before our eyes."

World powers are divided on how to stop the escalating violence in Syria and the Security Council is unlikely to refer the situation in Syria to the International Criminal Court in The Hague, which is not an official U.N. body.

Permanent Security Council members Russia and China have acted as Syria's protector on the council by repeatedly blocking Western efforts to take stronger U.N. action - such as sanctions - against the Syrian government to try to end the war.

Both sides to the Syria conflict have been accused of committing atrocities but the United Nations says the government and its allies have been more culpable.

"Syria is self-destructing," U.N. Secretary-General Ban Ki-moon told the Council on Foreign Relations on Monday evening. "After nearly two years, we no longer count days in hours, but in bodies. Another day, another 100, 200, 300 dead."

"Fighting rages. Sectarian hatred is on the rise. The catalogue of war crimes is mounting," he said. "The Security Council must no longer stand on the sidelines, dead-locked, silently witnessing the slaughter."

More than 50 countries asked the U.N. Security Council last month to refer the Syria crisis to the International Criminal Court, which prosecutes genocide and war crimes cases.

Syria is not a party to the Rome Statute, which set up the International Criminal Court, so the only way the court can investigate the situation is if it receives a referral from the Security Council. The council has previously referred conflicts in Libya and Darfur, Sudan to the court.

(Reporting by Michelle Nichols; Editing by Bill Trott)

Source: http://news.yahoo.com/syria-death-toll-likely-approaching-70-000-says-175206931.html

Jim Nabors The Americans bank of america online banking Adairsville Ga ashley judd Alois Bell Donna Savattere

By Khaled Yacoub Oweis, Reuters

AMMAN - Syrian National Coalition leader Moaz Alkhatib said on Sunday he was willing to hold talks with President Bashar al-Assad's representatives in rebel-held areas of northern Syria to try to end a conflict that has killed about 60,000 people.

The aim of the talks would be to find a way for Assad to leave power with the "minimum of bloodshed and destruction", Alkhatib said in a statement published on his Facebook page.

Sources in the coalition, an umbrella group of opposition political forces, said that Alkhatib, a moderate cleric from Damascus, met international Syria envoy Lakhdar Brahimi in Cairo on Sunday.

Brahimi played a main role in organizing meetings between Alkhatib and the foreign ministers of Russia and Iran, Assad's main supporters, in Munich last week.

The sources said that in their talks on Sunday the two men addressed the question of whether the coalition would formally endorse Alkhatib's peace initiative.

The Muslim Brotherhood, which controls a large bloc within the Islamist-dominated coalition, is against the initiative.

But the Brotherhood, the only organized political force in the opposition, is unlikely to challenge Alkhatib's authority directly, with his initiative gaining popularity in Syria, the sources said.

The Syrian authorities have not responded directly to Alkhatib's initiative -- formulated in broad terms last month. But Information Minister Amran al-Zubi on Friday repeated the government's line that the opposition was welcome to come to Damascus to discuss Syria's future in line with Assad's proposals for a national dialogue.

Alkhatib has headed the Syrian National Coalition since it was founded last December in Qatar with Western and Gulf backing. He has quietly built a student following and links with civic and religious figures across Syria.

RENEWED FIGHTING

His latest offer of talks coincided with opposition reports of fighting moving closer to central Damascus, after a rebel push into the east of the capital last week.

The Local Coordination Committees, a network of grassroots activists, said clashes broke out on Sunday in the al-Afif neighborhood of Damascus, which is adjacent to a presidential complex.

The organization said 77 people were killed in Syria on Sunday, including 16 people who it said had been executed by Assad's forces in the eastern city of Deir al-Zor. Such reports are impossible to verify as Syria severely restricts access for independent media.

The war is pitting Assad's minority Alawite sect, an offshoot of Shi'ite Islam that has dominated Syria since 1960s, against the Sunni majority that has led the protest movement.

When Alkhatib made his offer of talks last month, he made this conditional on the authorities starting to release tens of thousands of political prisoners jailed since the eruption of the 22-month uprising.

The United Nations said on Friday that it saw a glimmer of hope in Alkhatib's offer.

U.N. Under-Secretary-General for Political Affairs Jeffrey Feltman said the offer was "the most promising thing we've heard on Syria recently".

On Sunday, Alkhatib spelt out ideas on a venue for talks.

He said: "If the regime is so concerned about sovereignty and does not want to venture out of Syrian territories, then there is a suitable solution, which is the liberated land in northern Syria."

He added: "There is an important question. Will the regime agree to leave with the minimum of blood and destruction?"

Syria's uprising, which started as peaceful protests against four decades of autocratic rule by Assad and his late father, has turned into a violent sectarian conflict.

PRISONERS

Freedom for political prisoners is an important issue for the opposition. Alkhatib said even centrist opposition figures who were willing to talk with Assad, such as Abelaziz al-Khayyer, a veteran Alawite human rights campaigner, have been jailed.

"The regime deals with the demands to release the political prisoners, especially the women, in a totally inhumane way," Alkhatib said. "Despite two years of savage killing, the regime is still trying to buy time."

The scion of a religious family who have historically been custodians in the Umayyad mosque in Old Damascus, Alkhatib was a proponent of a negotiated solution while he was in Syria. But he was jailed several times during the revolt in secret police dungeons and was forced to flee the country.

Alkhatib said the regime missed a "rare opportunity' by not agreeing to release women prisoners by a deadline he had set for Sunday, but that he was compelled morally to continue to try to negotiate a peaceful exit for Assad.

Additional reporting by Yasmine Saleh in Cairo

weather new orleans orcl the hartford illinois primary 2012 michael bay zsa zsa gabor illinois primary

WIARTON, Ont. - It's Groundhog Day ? the day people across North America turn to weather prognosticating rodents in the hope they'll call for an early spring.

Their handlers say Canada's three furry forecasters ? Ontario's Wiarton Willie, Nova Scotia's Shubenacadie Sam, and Manitoba's lesser known woodchuck, Winnipeg Willow ? are ready to make their predictions.

In Wiarton, there is a three-day festival underway with concerts, ice carving and the highlight of Groundhog Day ? prediction morning.

Shubencadie Sam ? the first to be coming out of his burrow ? will be making his prediction to a worldwide audience via webcam and also to his followers on Twitter.

Winnipeg Willow will visit a Mountain Equipment Co-op store to make her prediction, along with an American Kestrel.

Folklore has it that if a groundhog sees its shadow on Groundhog Day it'll flee to its burrow, heralding six more weeks of winter, and if it doesn't, it means spring's around the corner.

Stateside, Pennsylvania's Punxsutawney Phil is generally regarded as the groundhog of record.

Source: http://news.yahoo.com/canadas-furry-weather-forecasters-ready-predictions-090358451.html

melissa gilbert deadliest catch dwts sean hannity bobby petrino fired buffett rule lollapalooza lineup

Rosa Golijan , NBC News ? ? ? 17 hrs.

We've referred to BlackBerry 10, the latest operating system released by Research in Motion (now known as BlackBerry), as the company's last hope. It's do or die, make or break, claim a hefty serving of the smartphone market or settle for a few crumbs. But setting aside all that pressure and drama, let's focus on what's important now: Will you actually want to buy a smartphone running BlackBerry 10?

Yes, no ? and maybe so.

The first device to run BlackBerry 10 is the Z10, an all-touch smartphone. Yes, you did read that right: The physical keyboard, a defining BlackBerry feature, is gone. Sure, it'll reappear with the Q10 ? the more traditional-looking of the first two BlackBerry 10 devices ? but that isn't expected to be available until April or so. For now, we can merely judge BlackBerry based on one device ... one that's a dramatic departure from the company's modus operandi.

Physically speaking, the Z10 is a beautiful device. It doesn't have some sort of flashy or daring design. Instead it's simple and unadorned, like a classy little black dress that'll seldom look out of place or out of style. Whenever I'd hand the Z10 to someone for the first time, he or she would remark that it feels a great deal like an iPhone. Take that however you will, but I see it as a good thing.

As far as the device's guts go, there's nothing that'll grab your attention too much. It has a 1.5GHz dual-core processor, 2GB of RAM, 16GB or memory (expandable up to 64GB, thanks to a microSD slot), an 8MP camera on the back, and a 2MP camera in the front. Oh, and there's a removable battery. (As someone who has gone a long time without having to deal with annoying BlackBerry freeze-ups, I'd forgotten how important it is to have a battery that can be yanked out, if only to force a restart. And yes, the Z10 has frozen up a couple of times during my review period.)

Touchy

It's not the hardware that's the main attraction when it comes to the Z10 though. As I've said, this is the first BlackBerry 10 device. And the operating system is the deal-maker ? or deal-breaker.